EWFORX.NET

USD/PEN S/3.9360; EUR/USD $0.9784; BITCOIN $19284;

GOLD $1659; USOIL $82.24;

Fundamental

This morning markets blood red again! The Dow Jones Futures is down 1.06%. And Europe isn’t faring any better with the Stoxx 600 down -1.43%. And Asia closed red last night with Shanghai down -0.13%.

Fundamentals

German inflation hit 10% in September. A level not seen since 1990! Market forecast was for 9.4% US Initial Jobless claims came in at a 5 Month low. And Euro Economic Sentiment is down at the 2-year low.

Technical Analysis

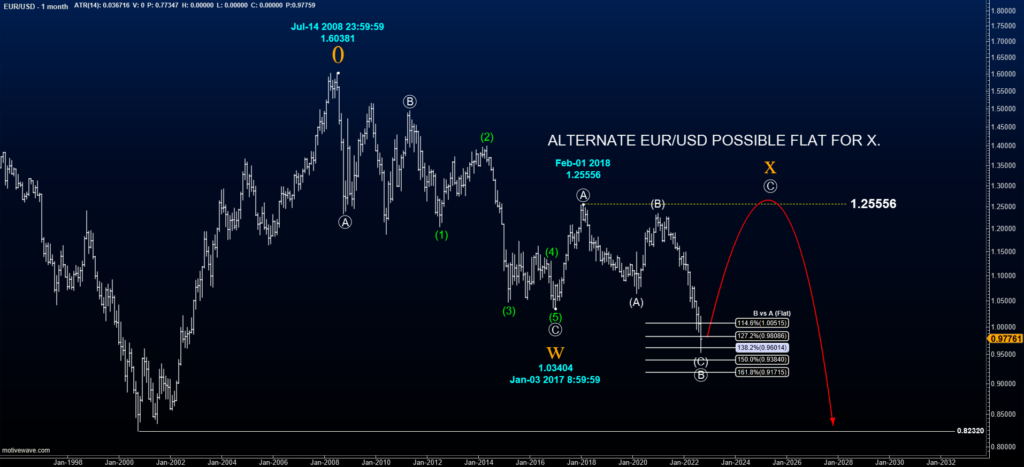

The disaster in Europe is driving EUR/USD to a 20-year low! The pair is now trading at the 0.9768! Technically, however, the Euro could be at a truing point. The move down from the 1.25556 Feb 12018 high is in three waves and has retraced to the 138.2% BvsA of a Possible flat formation for wave X. Price needs to move up above the 1.03404 Jan 3rd 2017 low for to keep this flat count in play. However, if the pair turns back down and falls below the 138.2% Fibonacci retrace, then the probability favors the downside. The 150% and 161.8% are key too but not secure. Usually when these B eaves fall past the 138.2 the count is invalidated for more bearish count.

The SPX500 is red today trading at the 3635.33. The index has been consolidation at Minor degree for about five days. Yesterday’s intraday low was the lowest point in this contraction. If price drops below this, then the next test is down at lower channel trend line.

The Peruvian stock market is holding up better than Europe and the States. Yesterday it put a nice day gaining 2.80% on the day. Today its flat but still holding onto yesterday’s gains. However, longer term the Commodity based index is on a downtrend as price is below the 200 EMA while in a death cross. The index should rally if my Elliott Wave count is correct. Target at the 50% retrace of the drop from the all-time high. I do not think the index can stay up in the global panic.

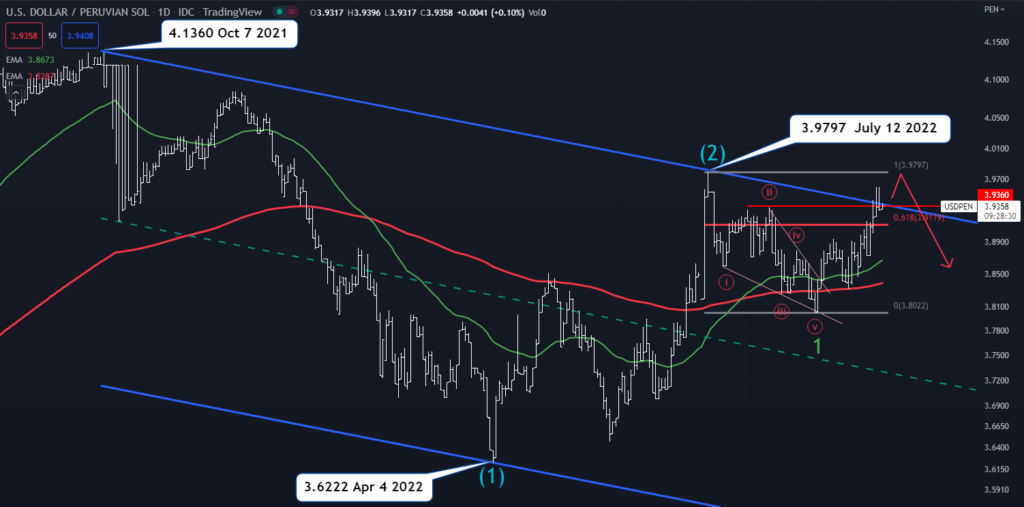

Technically the Sol looks weak against the dollar. So far price has mad e it above the 61.8% Fibonacci retrace of Green 1 and is now testing the 3.9381 red circled ii. The dollar intraday made it to the 3.9670 before settling down at the 3.9380. For this count to hold price needs to drop from these levels. A move above the 3.9797 July 12 high and USD/PEN could be heading up to the 4s again!